Portfolio Solutions Guide

Project Overview

While working for asset management firm Columbia Management, I was asked to reduce the production cost of our Quarterly Portfolio Review by 50%.

At a cost of approximately $500,000 per year, this piece accounted half of our annual marketing budget. Its contents were largely comprised of fact sheets for the company’s 90+ mutual funds.

Prior efforts to eliminate the book had failed. Both advisors and employees told us they needed all the information the book provided in one place.

Research Methodology

Using stakeholder and in-depth interviews, as well as contextual analysis, I set out to learn why the Portfolio Review was so important to users.

- Interviewed 10 internal stakeholders from different sales channels and different roles.

- Interviewed 10 advisors from wire house, regional, and independent firms.

- Reviewed similar guides from 7 competitive firms.

Verbatims from Stakeholder Interviews

Internal Stakeholders

External Stakeholders

Research Findings

The top findings from stakeholder interviews:

- Alphabetical organization by fund name made it hard to compare funds with similar investment objectives.

- Wire house advisors wanted to see our products categorized by their firm’s classification.

- Columbia Management leadership wanted to promote top-performing funds.

Observing advisors as they prepared for client meetings led to an interesting discovery. All of them had marked the pages of their book with post-it flags , dog-earred pages, etc. When I asked why they did this, they told me it made it faster for them to find the specific data they sought when comparing funds. Watching them do this, I could see they spent a lot of time flipping back and forth through our advisor guide. Understanding what data they most needed was key when creating the design of the new guide.

Redesign

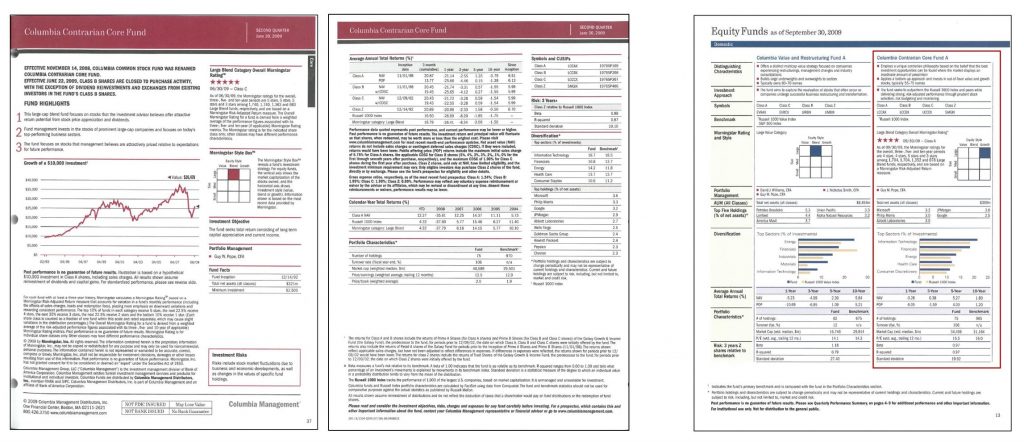

Based on the research findings the guide was radically redesigned:

- The redesigned pages showcased top-performing funds by investment category and provided key information to support comparison. For example, the four different large-cap funds at right can be compared by investment style, top holdings, and total return.

- We leveraged this new format to create customized guides for large wire house customers.

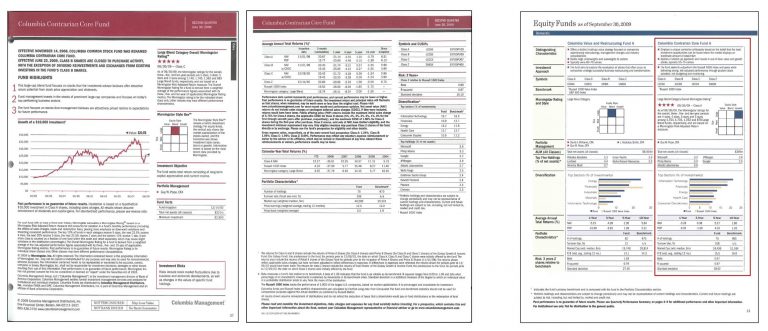

Columbia Contrarian Core Fund — Before & After

Results

The revised Product Solutions Guide was a success:

- Cost-savings targets were exceeded.

- 75% of advisors who responded to a survey preferred the new guide to its predecessor.